Cit Bank wire transfer time is a crucial factor for anyone using this service. Understanding the typical processing times, potential delays, and factors influencing speed is essential for effective financial planning and managing expectations. This guide provides a clear overview of the process, helping you navigate wire transfers with Cit Bank smoothly and efficiently. We’ll explore the various aspects impacting transfer speeds and offer helpful tips to ensure your transactions are processed quickly and securely.

Several factors contribute to the overall time it takes for a wire transfer to be completed through Cit Bank. These include the time of day the transfer is initiated, whether it’s a domestic or international transfer, the receiving bank’s processing times, and any potential compliance checks required. Understanding these elements will help you anticipate the likely completion time and plan accordingly.

Get ready to dive deep into the world of CIT Bank wire transfers! We’re going to unravel the mysteries surrounding transfer times, fees, and everything you need to know to make your wire transfers smooth and efficient. Whether you’re a seasoned business professional or a first-time user, this guide will equip you with the knowledge to navigate CIT Bank’s wire transfer process with confidence.

Understanding CIT Bank Wire Transfers: Cit Bank Wire Transfer Time

CIT Bank, known for its robust business banking solutions, offers wire transfer services for both domestic and international transactions. Wire transfers, as you probably know, are a fast and secure way to send and receive large sums of money. They are especially useful for urgent payments, international business dealings, and large-scale financial transactions. But how long do they actually take?

Domestic Wire Transfers with CIT Bank

For domestic wire transfers within the United States, CIT Bank generally aims for same-day processing. However, this isn’t a guarantee. The actual processing time can depend on several factors, including:

Source: payoneer.com

- Time of initiation: Transfers initiated early in the business day have a higher chance of same-day processing.

- Receiving bank’s processing time: Even if CIT Bank processes the transfer quickly, the receiving bank might have its own processing delays.

- Federal holidays and weekends: Transfers initiated on weekends or federal holidays will likely be processed on the next business day.

- Verification requirements: CIT Bank may require additional verification for larger or unusual transactions, which can cause a delay.

While same-day processing is the goal, it’s wise to allow for a one-business-day delay for domestic wire transfers to account for potential unforeseen circumstances. Always confirm the exact processing time with your CIT Bank representative for critical transactions.

International Wire Transfers with CIT Bank

International wire transfers are a bit more complex and generally take longer than domestic transfers. Processing times for international wire transfers can range from one to five business days, sometimes even longer depending on several factors:

Source: wise.com

- The destination country’s banking system: Different countries have different banking regulations and processing speeds.

- Intermediary banks: International transfers often involve intermediary banks, which can add to the processing time.

- Currency conversion: Currency conversion can add a step to the process and might introduce minor delays.

- Regulatory compliance: International transfers are subject to stricter regulatory scrutiny, potentially leading to delays.

Planning ahead is crucial for international wire transfers. Allow ample time for the transfer to complete, and always confirm the estimated processing time with your CIT Bank representative.

Factors Affecting CIT Bank Wire Transfer Times

Several factors can influence how long your CIT Bank wire transfer takes. Understanding these factors can help you manage your expectations and plan accordingly.

Source: exiap.com

Wondering about CIT Bank wire transfer times? It usually takes 1-3 business days, but for a definitive answer, your best bet is to call their customer service line at the CIT Bank 800 number for the most up-to-date information. They can give you precise estimates based on your specific transaction. So, before you get antsy, grab that phone!

Transaction Volume

High transaction volumes, particularly during peak business hours or periods of increased financial activity, can sometimes lead to minor delays in processing.

Technical Issues

While rare, technical glitches within CIT Bank’s systems or the receiving bank’s systems can cause unexpected delays.

Accuracy of Information, Cit bank wire transfer time

Ensuring the accuracy of all recipient information, including account numbers, bank names, and SWIFT codes (for international transfers), is crucial. Inaccurate information can significantly delay or even prevent the transfer from completing successfully. This includes verifying the correct BIC/SWIFT code for international transactions. Incorrect information can lead to significant delays and potential complications.

Compliance and Security Checks

CIT Bank adheres to strict security and compliance regulations. Larger transactions or those that trigger internal compliance flags might undergo additional scrutiny, resulting in slightly longer processing times. This is a crucial part of ensuring the safety and security of your funds.

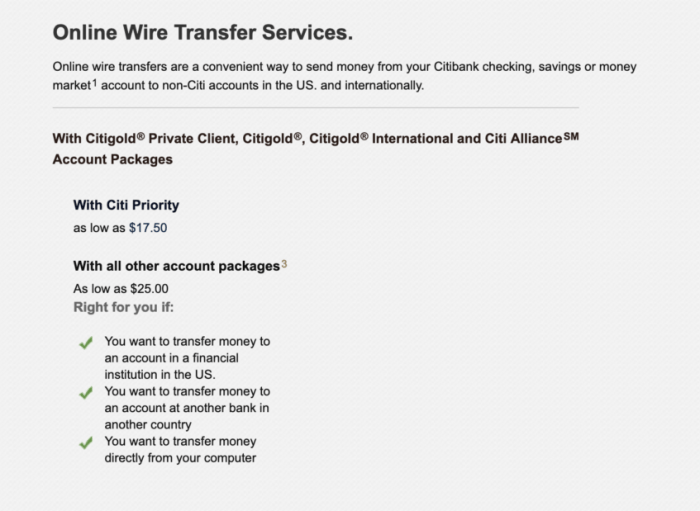

CIT Bank Wire Transfer Fees

CIT Bank charges fees for wire transfers, and these fees vary depending on the type of transfer (domestic or international) and the amount transferred. It’s always best to contact CIT Bank directly or check their official fee schedule for the most up-to-date information on wire transfer fees. Remember to factor these fees into your budget when planning a wire transfer.

Tips for Faster CIT Bank Wire Transfers

Here are some tips to help you expedite your CIT Bank wire transfer:

- Initiate the transfer early in the business day.

- Double-check all recipient information for accuracy.

- Provide all necessary documentation.

- Contact CIT Bank customer support if you have any questions or concerns.

- Understand the potential delays associated with holidays and weekends.

Frequently Asked Questions (FAQ)

- Q: What is the average processing time for a domestic wire transfer with CIT Bank?

A: CIT Bank aims for same-day processing, but allow for up to one business day. - Q: How long does an international wire transfer take with CIT Bank?

A: International transfers can take 1-5 business days, or even longer depending on various factors. - Q: What are the fees associated with CIT Bank wire transfers?

A: Fees vary depending on the type and amount of the transfer. Contact CIT Bank for the most up-to-date fee schedule. - Q: What happens if I provide incorrect recipient information?

A: Incorrect information can significantly delay or prevent the transfer. Contact CIT Bank immediately if you discover an error. - Q: Can I track the status of my wire transfer?

A: Contact CIT Bank customer service to inquire about the status of your transfer. - Q: What should I do if my wire transfer is delayed?

A: Contact CIT Bank customer support to investigate the cause of the delay.

References

While specific CIT Bank wire transfer processing time information isn’t publicly listed with exact timeframes, general information on wire transfers can be found on various financial websites. Always consult directly with CIT Bank for the most accurate and up-to-date information regarding their services.

Call to Action

Ready to experience the efficiency of CIT Bank’s wire transfer services? Contact CIT Bank today to learn more about their wire transfer options and fees! Don’t hesitate to reach out to their customer support for any questions or assistance you may need. Let’s get your money moving!

Successfully navigating Cit Bank wire transfers hinges on understanding the various factors influencing processing times. By being aware of these elements – from the initiation time to the receiving bank’s procedures – you can better manage your expectations and ensure a smoother transaction. Remember to always confirm the details with Cit Bank directly for the most up-to-date and accurate information relevant to your specific transfer.